Clearing the Confusion Around HMND Token Unlocks

It’s been 3 years since the launch of HMND, and we want to clear up how token unlocks actually work. Let’s start with the basics.

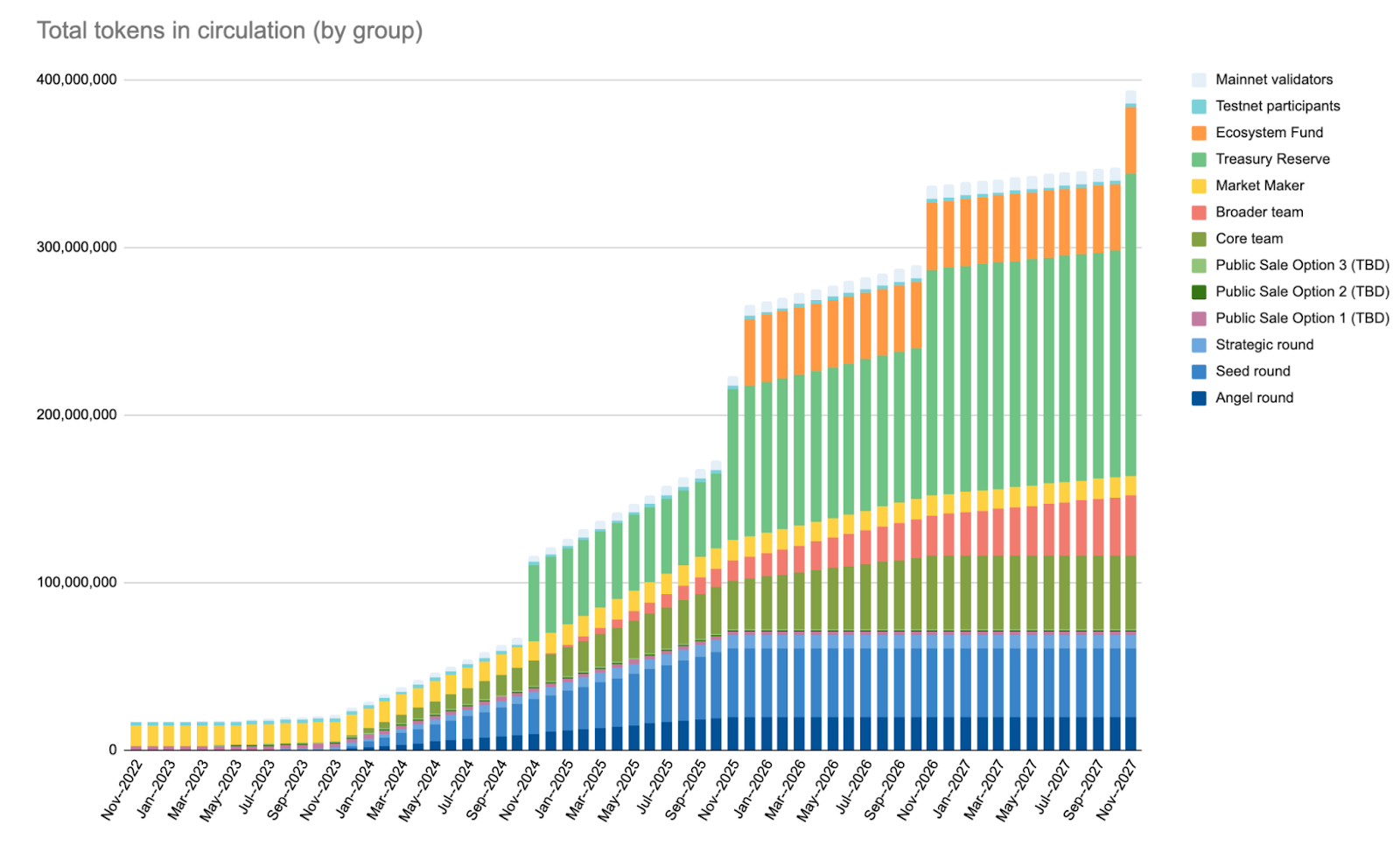

Here’s a quick overview of the main allocations:

- Angel and Seed – 2 years of block-by-block vesting, starting Nov 2023 and ending Nov 2025

- Strategic – 30 months of block-by-block vesting, starting Jun 2023 and ending Nov 2025

- Core team – 3 years of block-by-block vesting, starting Dec 2023 and ending Nov 2026

- Broader team – 3 years of block-by-block vesting, starting Dec 2024 and ending Nov 2027

- Market Maker – one-time at TGE (Nov 2022)

- Treasury Reserve – 4 annual unlocks, Nov 2024 through Nov 2027

- Ecosystem Fund – one-time in Dec 2025

- Testnet participants – one-time at TGE

- Mainnet validators – gradual stream from Jan 2023 through Nov 2026

In Humanode, most unlocks are linear. That means tokens don’t come out all at once. They are released little by little, block by block, second by second, like drops of water from a tap instead of a bucket being dumped at once.

Here’s how it works:

Investor and team allocations (Angel, Seed, Strategic, Core, Broader) are not cliff unlocks. They stream out continuously, block by block, second by second, during their vesting windows. There are no sudden cliffs where a million tokens appear in one day. Instead, the vesting contract releases small amounts at every block until the full allocation is reached.

Example: Angel round

- Allocation: about 5% of the total supply.

- Lockup: 1 year.

- Vesting: 24 months, beginning Nov 2023.

- This means that from Nov 2023 until Nov 2025, tokens are unlocked gradually. If you see charts that show “~830,000 HMND” released monthly, that doesn’t mean they come in one lump on the first of the month. It means that, averaged out, the vesting contract is releasing roughly that amount spread evenly second by second across the month. This means that by the end of Novemeber, early investors would have already sold their tokens or they are holding to the moon.

The same applies to Seed, Strategic, Core, and Broader team allocations. Each has its own start date and duration, but the principle is the same: tokens flow steadily, not suddenly.

The visible jumps you see on charts come from a few non-vesting items that are modeled as steps:

– Market Maker (one-time at TGE),

– Ecosystem Fund (one-time in Dec-2025),

– Treasury Reserve (annual additions each Nov 2024–2027).

This brings us to the concern about an ~11% unlock in November 2025. The tranche people are pointing at is the November Ecosystem and Treasury Reserve addition (≈45M HMND, ~11% of supply). These funds are managed by the Humanode Foundation and reserved for ecosystem growth.

It means that the funds will become available for ecosystem development. They do not immediately flow into the market, and there’s no plan to do so, especially at these prices. In fact, tokens from earlier treasury unlocks haven’t even been fully used yet.

Another point to clarify is that, if you can see in the graph below, you can identify that a 90+% portion of the angel, seed, and strategic round tokens has already been unlocked and the rest will finish by November 2025. That means there isn’t some big investor dump waiting around the corner. People have either already sold or they are holding until they reach the moon, whereas now HMND is below first funding round valuation.

So, remember that when you see websites showing “monthly unlocks,” it’s just because they don’t have the tools to display block-by-block vesting. They simplify it into monthly buckets. The truth is that tokens unlock every second, except for treasury and ecosystem funds, not all at once at the end of the month.

We hope that this clarifies some of the confusion.