The revolution that sold its soul

When crypto first appeared, it carried the energy of a rebellion. People were tired of banks calling the shots, tired of Wall Street gambling with their savings, and tired of central banks deciding what their money was worth.

The early cypherpunks said you could “be your own bank,” and for a moment, it felt like a real break from the world that failed everyone in 2008. No branches or gatekeepers. Just you, your keys, and a network that didn’t care who you were or how much you had.

But fast forward to 2025, and the picture looks very different. Bitcoin and Ethereum now sit inside regulated ETFs. The same names crypto tried to escape; BlackRock, Fidelity, Franklin Templeton, and others, hold a massive portion of the supply and control most of the onboarding. Tokenized treasuries and RWAs are being issued by TradFi giants who brought their own rules with them.

And for most people today, “using crypto” means opening a centralized exchange app and buying a product packaged by someone else. No private keys or sovereignty whatsoever. Just another asset in a familiar wrapper.

So the revolution didn’t end. It didn’t fade. It got bought and captured. The tools that were supposed to break away from the old system are now sitting neatly inside it.

And that brings us to the question that matters.

If the rails of the rebellion now belong to the same institutions it fought against, what comes next?

What crypto was actually fighting: TradFi as the original gatekeeper

Before getting into where crypto went, it helps to be clear about what it was pushing against in the first place. Traditional finance is not a mystery. It is a network of bankers, brokers, asset managers, custodians, clearinghouses, and all the other institutions that sit between you and your own money. Each of them handles a piece of the process. Each of them adds a rule, a fee, or a waiting period. Over time, those layers stack up, and the person who actually owns the value becomes the last one in line.

Most people don’t notice how much power sits in those layers. A handful of large firms decide who gets access to credit. They choose which assets can move freely and which ones cannot. They influence liquidity across markets, and at times, even the direction of monetary policy. If they pull back, entire sectors slow down. If they push forward, markets surge. Retail users, on the other hand, mostly receive whatever products are handed to them. A savings account. A brokerage fund. A credit line. They use the system but don’t shape any part of it.

So the issue was never that financial services exist. Moving money, storing value, and providing credit are things every society needs. The real problem is when a very small group can freeze transactions, reprice assets, or reroute flows for millions of people with little notice and no real accountability.

That is the kind of gatekeeping that pushed people to look for something different, and it is what the early crypto movement was responding to. But even though some people still talk about crypto as if it is standing outside the gates of traditional finance, waiting to take over. But if you look at what actually happened over the last few years, the story is almost the opposite.

How TradFi walked into crypto and made it a product

Some people still talk about crypto as if it is standing outside the gates of traditional finance, waiting to take over. But if you look at what actually happened over the last few years, the story is almost the opposite. Crypto didn’t replace TradFi. TradFi stepped inside, took a seat, and turned crypto into something it already knew how to package and sell.

A clear example is the rise of spot Bitcoin and Ethereum ETFs. These funds now hold a massive amount of the total supply, sitting under the custody of large financial institutions. For most newcomers, buying Bitcoin no longer means downloading a wallet or learning what a private key is. It means tapping a button in a brokerage app and purchasing a product managed by BlackRock or Fidelity. The experience feels the same as buying a stock or an index fund, because that’s exactly how it has been designed. Crypto becomes another line item in a familiar investment portfolio.

The same pattern shows up in tokenized real-world assets. Tokenized treasuries, credit products, and other RWAs are growing quickly, and most of them are issued or managed by the same asset managers who run traditional bond funds and money market products. The tokens travel across blockchain rails, but everything else, the issuer, the structure, the terms, remains firmly in TradFi’s hands. The promise of turning assets “on-chain” has been framed as democratizing access, but the gatekeepers look awfully familiar.

To be fair, having serious financial players using blockchain rails is not a bad thing. It brings liquidity. It brings adoption. It brings stability that early crypto did not have. But it also means that the rules, the flow of rewards, and the upside are still shaped by old financial power. The rails changed. The control didn’t. And that is how crypto ended up as a product inside the very system it once tried to escape.

DeFi rebuilt the same pyramid on-chain

When people talk about decentralization, they often point to DeFi as the cleaner alternative. No banks. No brokers. No custodians in the middle. Everything on-chain, open to anyone who wants to use it. And yes, this was the goal. But if you look closely at how most networks actually operate, you notice a structural issue that has been there from the beginning. Power is measured in tokens, not in contributions. The more tokens you control, the more influence you have. Over time, this simple rule shapes the entire system.

You can see it clearly in Proof of Stake. A few liquid staking providers, big exchanges, and large pools hold a large portion of the stake on major chains. That means the security of the network and the flow of rewards end up concentrated around those same entities.

In theory, anyone can run a validator. In practice, most people delegate to the largest operators, who then grow larger and gain even more weight in consensus.

The same pattern shows up in governance. Many DAOs experience low turnout. Most token holders never vote, or simply delegate their votes to a few well-known names. Early investors and core teams often hold a disproportionate share of tokens, which gives them a louder voice than the rest of the community combined.

There are cases where a handful of wallets decide major protocol directions, sometimes with less than one percent of the total holder base participating. This is not because people do not care. It is because the structure itself rewards concentrated power.

When people say “on-chain democracy,” what they often mean is “whoever has more tokens calls the shots.” And once you accept that design, the outcome becomes predictable.

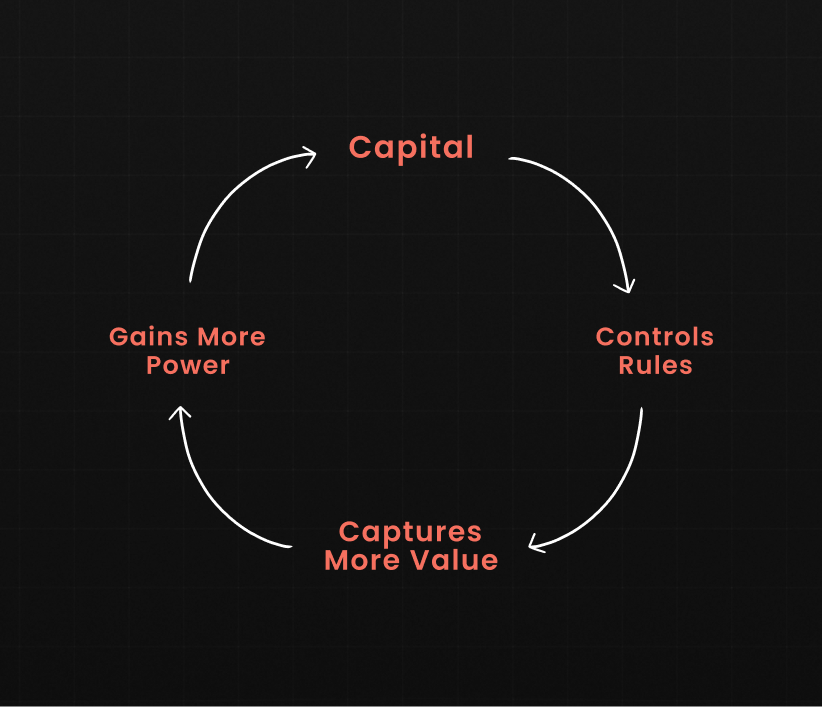

Even if TradFi never touched these networks, the system would still push power upward over time. Wealth buys influence, influence shapes decisions, and decisions reinforce the position of those who already hold the most. It is the same pyramid, just drawn with different tools.

This is the limitation that early crypto did not fully solve. You can remove the banks and still end up reproducing the same hierarchy, simply because the underlying rule, power tied to capital, never changed.

Real villain: financial capture, not crypto

Up to this point, it might sound like the problem is Bitcoin, or DeFi, or tokenized treasuries, or ETFs. It isn’t. The real issue sits underneath all of those things. It is any design where financial and political power can be captured by whoever controls the largest pool of capital. If that root condition stays the same, it does not matter how modern the rail looks. Over time, the system will lean toward the richest balance sheets.

You can think of “financial capture” in simple terms. It is what happens when a small group can steer the rules, the flows, and the outcomes of a system because they sit on most of the money inside it. They do not have to own everything. They just need enough to influence how credit is issued, how assets are priced, and which risks are acceptable. Once that level of influence is reached, everyone else mostly reacts. They do not really shape the path.

In TradFi, this is easy to see. Central banks decide base rates and set the tone. Megabanks decide who gets large credit lines and who does not. Asset managers and large funds, including the ones running ETFs and big fixed-income products, decide which assets become “investable” at scale. Together, they define what is normal, what is liquid, and what is off-limits. Most households and smaller players simply choose from the menu.

In crypto, the pattern shows up in a different form, but it is still there. Whales who accumulated large positions early can swing markets or dominate votes. Early insiders and teams often hold big allocations that translate into long-term influence. Mega funds and market makers add another layer on top. In proof-of-stake networks, large staking providers and cartels can end up steering both security and governance. On paper, everything is open. In practice, a small group still has outsized power.

So if power keeps mapping to capital, switching from bank databases to blockchains does not solve the core problem. You can change the settlement layer, you can tokenize assets, you can add smart contracts, but the direction of influence remains the same. Those with the most to deploy will eventually find the levers and pull them.

If you want a different outcome, you need a system where that mapping is broken at the base layer. A network where being a human, not being a large capital holder, is what gives you a seat at the table. Without that shift, every new financial architecture, no matter how innovative, will slowly be pulled back into the same shape.

Why this model is structurally hard to capture

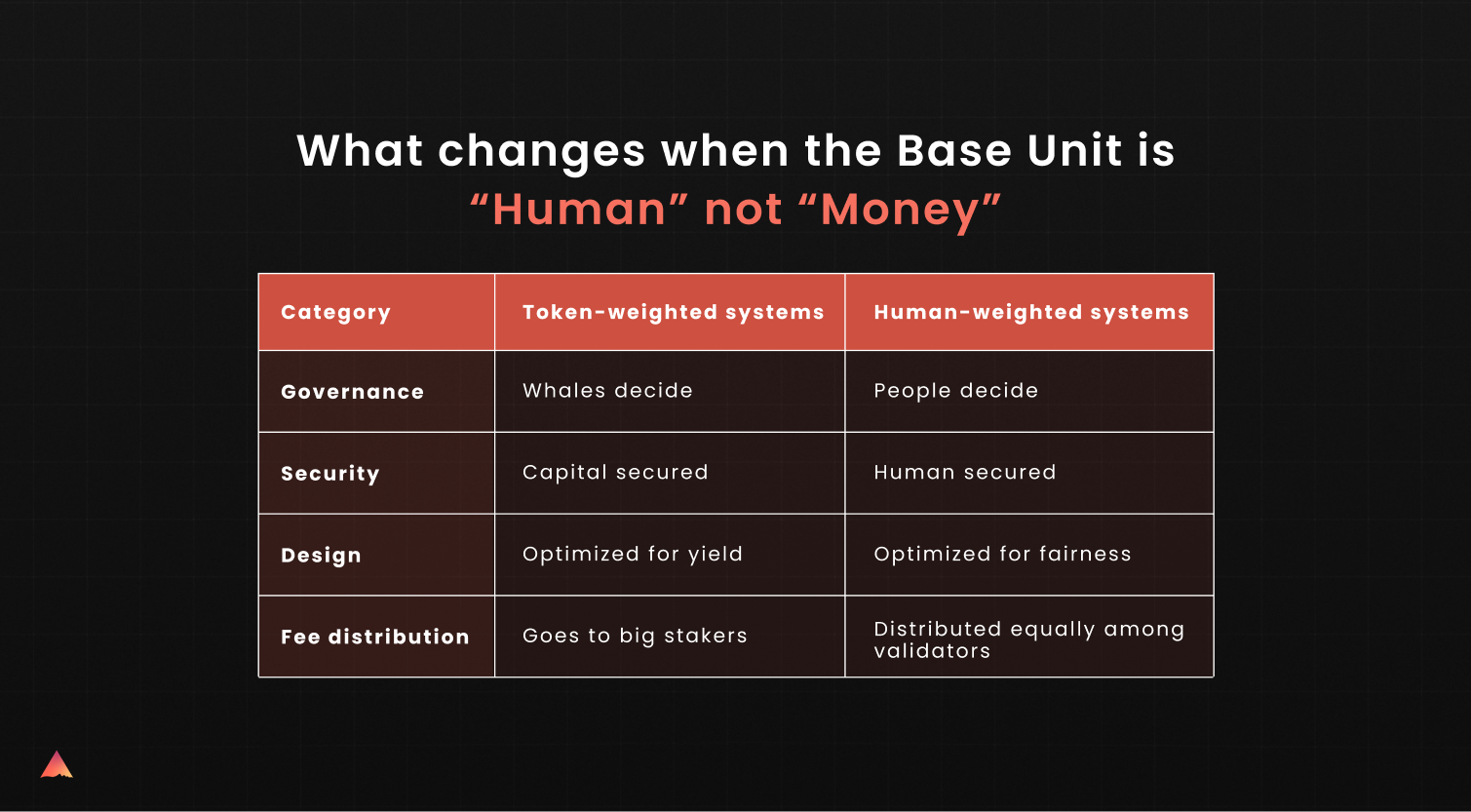

Most systems make power a function of capital. If you want more influence, you bring more money. You buy more stake, run more validators, or accumulate more tokens. Humanode breaks that.

In a one-human-one-node network, no amount of capital gives you extra consensus weight. Proof of Biometric Uniqueness (PoBU) makes sure that each validator represents a single living human, and that no one has taken more than one slot. Validation is tied to uniqueness, not balance sheets.

Governance follows the same logic. Vortex, the Humanode governance body, is built around people, not token balances. Every verified human can participate regardless of how many HMND they hold. Influence comes from participation and persuasion, not from financial position.

The contrast to typical Proof-of-Stake systems is clear. More tokens lead to more rewards and more political power. Humanode removes that path entirely. You cannot scale yourself through validator farms or dominate decisions by accumulating a larger bag.

This creates a different kind of bottleneck. To capture Humanode, you would need to coordinate or control actual people at scale. You cannot take over the network with a large fund or by buying tokens in bulk. You would need individuals to willingly hand over their validator power or follow your lead inside Vortex.

That is the structural point. The system anchors influence in humans, not capital, making it resistant to the same forms of capture that shape TradFi and much of crypto. Markets can still function. Projects can still grow. Fees can still circulate. But the base layer does not drift toward whoever can pay the most. The unit of power is a person, and that is what keeps the system grounded in human participation.

The trade-offs and open questions

A network run by real human beings instead of capital sounds refreshing, and in many ways it is. But it is not a magic wand. It comes with its own weight, its own questions, and its own uncomfortable edges. Being honest about that matters. If you are trying to build a financial system that belongs to people, you should expect the work to be harder than spinning up another speculative chain.

Start with identity. Humanode promises one human equals one node, but that only works if the system can actually confirm that the person behind the node is alive, unique, and not duplicating themselves through a dozen fake accounts. That’s where Proof of Biometric Uniqueness comes in, and why the system relies on encrypted liveness checks instead of IDs, passports, or raw biometrics. Still, this one-human-one-node rule isn’t without challenges. Someone could try to lease out their identity. Someone could be pressured by others. Someone could try to cheat the system through coercion instead of code. The network has defenses, but pretending these risks don’t exist would be unrealistic.

Then there’s the question of adoption. A wallet connect takes three seconds. A biometric verification takes a little bit longer and asks the user to do more. Some people won’t want to bother. Some won’t want to engage at all unless they understand why this friction exists. That means the network may grow more slowly than chains that rely purely on speculation and speed. It’s a trade-off: you lose a bit of convenience to gain protection against Sybil attacks and capture.

Governance is its own challenge. Moving to one-human-one-vote doesn’t magically make voters smarter, more active, or perfectly aligned. Humans skip elections. They get confused. They fall for narratives. And yes, they can be influenced by conversations happening off-chain. Vortex, the governance system built for Humanode, is designed to keep the field level, but it can’t remove human nature. It just ensures that everyone starts from the same baseline of power.

These open questions don’t weaken Humanode. If anything, they make it stronger, because they force the network to confront the real issues that come with decentralization. Instead of pretending everything is solved, the system accepts that the hard problems, identity integrity, social pressure, governance complexity, slower growth, are worth struggling with. These are the right problems to face if the goal is a financial system that actually belongs to people, not whoever happens to have the deepest pockets.

What a human-run financial system could unlock

Once you accept that the base layer is built around humans instead of capital, a different kind of financial system becomes possible. Not theoretical. Not utopian. Simply different because the incentives shift. The rules shift. And the outcomes start drifting away from the usual pattern where bigger balances get bigger voices.

In a network where every validator is a verified person, not a capital position, fees don’t concentrate in one corner. They flow across a wide population of human nodes, the same way Biostaking rewards flow across real, unique people instead of a few oversized pools. The network can grow without creating a privileged class that quietly accumulates most of the upside. It means the system stays healthy because more humans are actually participating, not because a few entities are subsidizing it.

You can also design financial tools that don’t need to bolt on Sybil resistance as an afterthought. Lending, insurance, staking, or marketplaces can assume from the start that every participant is an actual person, not an array of bots pretending to be one. It removes the constant worry of “who is on the other side of this?” and lets protocols focus on risk, pricing, or user experience rather than Sybil defense.

Governance also starts to change. Human votes, not whale allocations, can guide decisions around upgrades, monetary policy, grants, or treasury use. This is closer to how real communities make decisions. People don’t need to buy their way into a voice. They already have one by existing in the network. And while humans will still disagree, argue, or hesitate, the field is fair. One person. One node. One vote.

All of this loops back to the original vision that brought people into crypto in the first place. A system where regular users don’t just hold a token and hope it appreciates. They help run the network. They benefit from its activity. They are part of the foundation, not sitting outside it while institutions shape everything above their heads.

A human-run financial network opens doors that capital-weighted designs can’t. Not because it is perfect. But because it hands structural ownership to the people who rely on the system, instead of the entities that can afford to buy it.

Summing Up

If you look back at how all of this started, the pattern is hard to ignore. Traditional finance controlled the gates. It decided who could move money, how fast, and under which rules. That was the world crypto first pushed against. “Be your own bank” wasn’t a slogan. It was a reaction to a system that kept too much power in too few hands.

And for a while, the push worked. But over time, the same institutions that crypto tried to avoid stepped back in. Slowly, the rebellion grew comfortable being sold in regulated, familiar packaging.

Crypto hasn’t failed. The power structure underneath it has. As long as influence comes from capital, the outcome will always tilt toward whoever has more of it. Whether the system runs on-chain or off-chain doesn’t change that.

Humanode exists because of this exact problem. It takes the part that keeps getting captured, the base layer, and flips it. One human. One node. One vote.

So if you still believe finance should belong to the people who use it, you eventually run into the same question: who gets power by default?

If the answer is capital, the story ends the same way every time.

Human-weighted networks are a different answer. They are slower, more demanding, and more human. But they give you a chance to build something that doesn’t drift back into the hands of the richest balance sheets.

The second revolution isn’t about inventing a new token. It’s about choosing who sits at the foundation of the system: money or people.

And the only thing left to decide is whether enough humans are willing to show up and hold that foundation themselves.