BioDeFi - A Focus on Humanode's Approach to Use Biometrics in DeFi

Decentralized Finance (DeFi) once the hottest sector in crypto faces years-long stagnation. Since the start of 2022, the sector has shed 75% of its total value locked (TVL).

Even though the dust is yet to settle, a steady flow of details allows investors, project owners, and communities to piece together a picture highlighting the reasons for its failure. And among those reasons, security vulnerabilities and user experience are the most highlighted ones.

In their report Year Ahead For DeFi, Delphi Digital highlighted difficulties in onboarding new users as one of the prime reasons for the failure. Similarly, a conclusive article by HBR pointed out that token-based governance in the DeFi DAOs could be exploited by Sybil attackers. The attackers can maliciously gain hold of governance tokens by creating multiple identities and manipulating the decision-making.

Additionally, by creating multiple identities Sybil attackers can create fake reputations and gain undeserved privileges.

And that’s not even all!

Consider the hacks in DeFi that keep growing in volume every year. According to The Block, only 7.6% of all the hacked volume is recovered. Here’s a comprehensive view of the hacks in DeFi during 2020-2022:

Considering all these issues, is there any way to counter these problems? Many researchers identified using Biometrics as the solution. Does it really work? Let us explore in this article.

Biometrics in DeFi - Opportunities and Challenges

Biometrics offers a unique solution to these challenges. With biometric verification, unique physiological and behavioral traits of individuals serve as their identity, bringing a new layer of security to the DeFi ecosystem. By ensuring that each user is uniquely identified and verified, biometrics can mitigate the risk of fraudulent transactions and enhance trust among participants.

Moreover, the application of biometrics can simplify the user experience. In the complex world of blockchain and DeFi, biometrics can provide an intuitive method for user verification, reducing the complexity involved in handling cryptographic keys or passphrases. It can also aid in reducing over-collateralization in DeFi lending, as the lenders could verify the borrowers based on their biometric data.

In their comprehensive report on Mitigating identity attacks in DeFi through biometric-based Sybil resistance, Paradigm highlighted how Biometrics could help DeFi in the fight against Sybil attacks.

However, despite its potential benefits, the use of biometrics in DeFi isn't without challenges. Privacy is a primary concern - users must be assured that their biometric data, which is deeply personal, is handled with the utmost care. Security is another issue, as biometric data if compromised, cannot be replaced like a password or a private key. Moreover, using Biometrics for verification is deemed as losing the anonymity of the user which itself is one of the basic principles of Blockchain.

Considering these challenges, many DeFi protocols remain reluctant to use Biometrics.

This is where Humanode’s cryptographically secured private biometric verification technology plays a vital role. Let me explain.

Humanode's approach to using biometrics

By using crypto-biometrics, Humanode utilizes biometrics in a way that the users’ private biometric info is never shared with anyone, not even the developers behind the projects. The only purpose of using biometrics is to identify that a person is unique and alive so the anonymity of the user is never compromised.

Humanode’s crypto-biometrics is being utilized to verify the authenticity of the users in Discord. BotBasher a working application of Humanode’s tech is being deployed in Discord where famous projects like Sei, and BitMart use it to verify that their audience is actual human beings. Currently, BotBasher has over 220K verified users within 3 months of its beta launch.

In essence, this is how Humanode’s verification process works:

1- A user simply needs to scan their face for about 6-10 seconds using any device equipped with a camera of 3 megapixels or more. The neural network then transforms this real-time video feed into an anonymized 3D template, while concurrently confirming the authenticity of the individual in front of the camera.

2- Next, this biometric template and liveness data are securely encrypted and transmitted to confidential biometric servers. These servers promptly discard the liveness data after verification. The newly created anonymized 3D template is then compared to existing templates registered within the system.

3- Finally, the servers generate a unique ID based on this comparison and transmit it either to the Humanode blockchain or directly to the application.

Now let’s explore how Humanode’s biometrics-based Sybil-resistant mechanism can be used to provide enhanced security and reliability to the DeFi ecosystem without compromising the security and privacy of the users.

The idea of Humanode’s onchain verification is to create DeFi applications that use Biometrics as a way to authenticate and authorize users without getting access to biometric data. We call it BioDeFi (Biometrically secured DeFi applications).

Users will map their Biometrics to a specific HMND address that will be considered their digital identity and utilized by the DeFi applications as a unique identifier.

With the Humanode EVM compatibility in the testing phase and expected to be rolled out on Mainnet soon, DeFi protocols will be able to either deploy smart contracts on the Humanode chain or integrate the bio-authorization into their application to authenticate and authorize users.

Here are the possible uses of Humanode’s technology in the BioDeFi ecosystem:

Use Cases of Humanode's Crypto-Biometrics in DeFi

User Authentication in DeFi Platforms

In DeFi platforms, transactions are tied to a public-private key pair. If a private key is lost or stolen, assets may be irretrievable. Using Huamnode-verified identities, DeFi applications can link transactions to a unique user, creating a secure form of user authentication that cannot be lost or stolen.

Anti-Fraud Measures

Crypto-biometrics can be utilized to secure DeFi platforms against fraudulent activities. By verifying each user biometrically, DeFi platforms can ensure that each transaction is linked to a unique human identity, reducing the potential for Sybil attacks where a single entity poses as multiple users.

Verification in Peer-to-Peer Lending

Decentralized crypto lending platforms, a standout application of DeFi aren't without their share of issues. The prominent concerns include trust violations like fund hacking and the creation of multiple accounts for lending and borrowing purposes, which can potentially lead to severe ramifications.

Integrating crypto-biometrics can offer these lending platforms a robust method of verification for crypto lending without necessitating users to provide their personally identifiable. It's a beneficial scenario for both lenders and borrowers. At the same time, it addresses a significant concern for lending platforms - establishing a reliable trust framework and ensuring accountability.

Token Distribution

Token distribution events can use Humanode's crypto-biometric system to ensure that tokens are distributed fairly among unique human users. This can prevent any single user from claiming multiple shares by creating multiple accounts. Learn more about the Sybil-resistant retroactive airdrops.

DAO Governance Voting

Humanode's system can be utilized to secure the voting process in DeFi protocols. By verifying voters biometrically, it can ensure that each vote cast is tied to a unique human identity, preventing a single entity from casting multiple votes and manipulating the voting process. Learn more here.

Digital Identity Solutions

Digital identities can be securely established and verified using Humanode's crypto-biometrics. In a DeFi context, these identities can be used to authenticate users for various services, such as loans, insurance, or decentralized applications (dApps). A unique humanode-verified identity can serve as a decentralized identifier. Learn more here.

Security in DeFi Insurance

DeFi insurance platforms can utilize Humanode's system for verification when processing insurance claims. By utilizing Humanode’s verification the insurance companies can ensure that the person is the same who they claim to be. This can help in preventing fraudulent claims, ensuring that payouts go to the intended recipients.

Credit Scoring in DeFi Lending

Credit scoring linked to the Humanode verified entity can contribute to creating a robust scoring system just like in traditional finance but without asking users to give their personal information. The credit scores will be linked to the humanode-verified identity and their creditworthiness could be easily tracked based on their behaviors within the DeFi ecosystem. Learn more here.

Reducing Collateral Requirements

By providing a secure way to verify borrowers' identities, cryptobiometrics can potentially reduce the collateral requirements in DeFi lending platforms. This could make DeFi loans more accessible to a broader range of borrowers without asking for the user's personal information.

Biometric LP Staking

Using confidential Sybil resistance, we can make sure that one person can stake LP tokens only with one address and scale the LP rewards non-linearly depending on the amount of LP tokens. Giving more in APY% to smallholders and less to huge market makers. The goal is to onboard not only TVL but a lot of smaller LPs.

There is a user base of 220k humans who used our tech for verification during the last 3 months to pull into a new protocol. As the first step, we expect it to become the main staking venue since our consensus does not require stakes from validators. The next step will be onboarding other projects to the novel LP staking scheme.

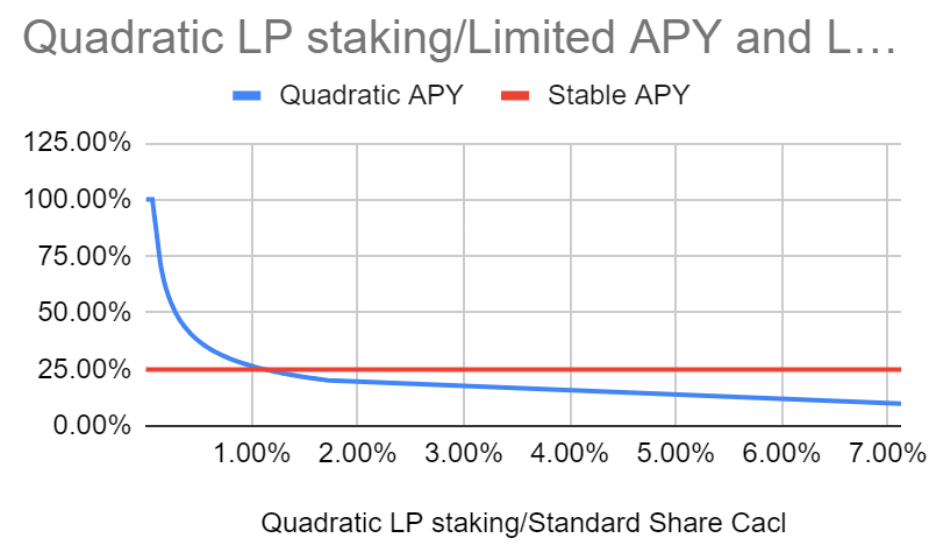

Here is a draft model of how quadratic rewards will look like:

Besides calculating the square roots of the liquidity provider’s share in the pool we limit the APY with the lower and upper boundary. The upper limit disincentives sock puppeting while the lower one gives confidence to large LPs that they will not lose due to impermanent loss.

Securing Repayments

With biometrics, borrowers' identities are linked to their loan obligations. This can help secure repayments by holding borrowers accountable and possibly improving repayment rates and reducing defaults. When their biometrics is tied to digital identity, the malicious borrowers will not be able to create multiple identities and scam the lending platforms.

Interest Rate Adjustments

Lenders can use Humanode's system to offer personalized interest rates based on individual borrowers' biometrically-verified lending history. This can contribute to a more equitable lending system that takes into account a user's history and behavior.

Biometric-Based Reputation Systems

Using crypto-biometrics, Humanode can help establish reputation systems in DeFi. These systems could link users' transaction history and behavior to their biometric identity, helping to establish trust within the DeFi community.

Security in Decentralized Exchanges (DEXs)

In decentralized exchanges, where users trade directly with each other, Humanode's biometric verification can add a layer of security by ensuring that each user is unique and verified. This can help to prevent fraud and manipulation in these peer-to-peer environments. Learn more here.

Summing Up

The integration of biometrics into DeFi, as enabled by Humanode's crypto-biometrics, significantly enhances the security, accessibility, and usability of DeFi platforms. By providing robust user authentication and tackling challenges such as identity fraud and Sybil attacks, private biometrics verification strengthen trust within the DeFi community.

But the potential of crypto-biometrics goes beyond merely enhancing existing systems. It opens up new possibilities for DeFi platforms. The ability to accurately, privately, and securely verify the uniqueness and humanness of users could pave the way for more advanced systems of credit scoring, reputation management, and personalized financial services.