Humanode in Simple Terms - Staking vs LP staking

For the inexperienced, the world of DeFi can seem daunting, with terms like staking, liquidity pools, Automated Market Makers (AMMs), and decentralized exchanges (DEXs) floating around. This guide aims to demystify these concepts, providing a clear and comprehensive understanding for everyone from beginners to seasoned 'Degens' in the DeFi space.

We will first look at the differences between usual staking and liquidity pool (LP) staking. Each has its own set of rules, rewards, and risks, and understanding these is crucial for anyone looking to navigate the DeFi world effectively.

However, the primary focus of our exploration will be on an innovative approach within the LP staking realm: Humanode's Sybil Resistant Nonlinear LP Staking. This unique model promises to redefine the norms of liquidity staking, offering a more convenient, profitable, secure, and safe option compared to traditional linear LP staking methods.

Let's start this journey together. We will simplify complex ideas and learn all about traditional staking and LP staking in DeFi.

Understanding Simple Staking

Staking involves locking up crypto assets within a blockchain network. It's a process that supports the network's operations and, in return, rewards participants with additional tokens. This is particularly common in networks that use a Proof of Stake (PoS) mechanism. There are two primary forms of staking: active and passive. They differ in terms of participation level and reward potential.

Active Staking

Active staking in the context of PoS is a hands-on approach. Here, participants, often referred to as ‘stakers’, not only lock their tokens but also actively engage in the network's operations. This includes validating transactions and creating new blocks.

Imagine a community election where your vote's weight depends on the amount of a particular asset you hold. In active staking, you’re not just voting; you're also participating in the governance and maintenance of the blockchain’s integrity. The more assets you stake, the higher your chances of being chosen to validate transactions and create blocks, leading to potentially higher rewards.

Advantages

- Higher Rewards: Active participation generally offers higher staking rewards than passive staking.

- Direct Network Involvement: Validators play a crucial role in maintaining the network’s security and efficiency.

Disadvantages

- Requires More Involvement: Active staking demands time and money, as it involves participation in network governance.

- Higher Risk: There’s a potential risk of penalties (known as 'slashing') if the network’s rules are violated by validators.

Passive Staking

Passive staking is a simpler form of staking. Here, you lock your tokens in the network, but unlike active staking, there’s no need for direct involvement in network operations. This type of staking is often seen on centralized exchanges such as KuCoin’s staking.

Consider passive staking like a savings account for your crypto. You deposit your tokens, and in return, you earn interest (staking rewards). Your involvement ends after locking in your assets, making it a time-efficient way to contribute.

Advantages

- Simplicity: It’s straightforward and doesn’t demand active governance participation.

- Lower Risk: Unlike active staking, there’s typically no risk of penalties.

Disadvantages

- Lower Rewards: The trade-off for its simplicity and lower risk is typically lesser rewards compared to active staking.

- Limited Influence: Passive stakers don’t have a say in the network’s governance and decision-making processes.

Staking can be a lucrative way to participate in the crypto world, whether actively or passively. Each type has its advantages and suits different investor profiles. Active staking in PoS networks, with its higher rewards and direct involvement, appeals to those looking for a more hands-on investment. In contrast, passive staking offers a simpler, less time-consuming way to earn rewards. Understanding the differences between these two forms of staking is crucial for anyone looking to delve into the Staking.

Understanding Liquidity Pool (LP) Staking

As we've seen, staking offers diverse opportunities in DeFi, from active engagement to passive income. Now, let's pivot to another key aspect of DeFi that intertwines with staking – Liquidity Pools and LP Staking, where the dynamics of participation and rewards take an interesting turn.

What are Liquidity Pools?

Liquidity pools are integral to the DeFi ecosystem, reshaping how trading occurs on decentralized exchanges (DEXs). Liquidity pools are collections of funds, typically consisting of a pair of tokens, locked in a smart contract. These pools provide the necessary liquidity for trading activities on DEXs.

Users contribute an equal value of two different tokens to the pool, creating a reservoir for trading. For example, a liquidity pool might consist of a pairing like Ethereum (ETH) and a stablecoin like USDC. Users who add their assets to these pools, known as liquidity providers (LPs), enable token swaps and trading. They earn fees from the trades executed in the pool, proportional to their share of the pool's liquidity.Liquidity pools didn't just appear out of thin air; they have a fascinating history that mirrors the innovative spirit of the DeFi sector.

The concept of liquidity pools gained traction with the advent of Automated Market Makers (AMMs). The first AMM DEX, introduced by Bancor in 2017, revolutionized liquidity maintenance using smart contracts. This marked a departure from traditional order book-based trading systems.

The launch of Uniswap in late 2018 further popularized DEXs and liquidity pools. Uniswap's Ethereum-based protocol allowed users to trade ERC-20 tokens directly from the pools, enhancing accessibility and permissionless trading.

How Liquidity Pools Function?

Consider a scenario where two individuals want to trade different tokens, say A and B. In a liquidity pool, these individuals contribute an equal value of tokens A and B to the pool. This pool then allows others to swap token A for token B and vice versa. The price of these tokens in the pool is determined by the balance of A and B and the trading rules set by the AMM.

Advantages and Challenges

- Advantages: Liquidity providers earn transaction fees, contributing to a seamless trading experience in the DeFi space. They become an integral part of the market, facilitating efficient trade.

- Risks: Key challenges include impermanent loss, especially in volatile markets, and risks associated with the tokens in the pool, like smart contract vulnerabilities and regulatory uncertainties.

Liquidity pools, with their novel approach to trading and liquidity provision, have become a cornerstone in the DeFi ecosystem. They offer a unique way for users to earn passive income and play a vital role in the functionality and efficiency of DEXs. Understanding these pools, their structure, and their function is essential for anyone looking to engage in the dynamic world of decentralized finance.

The Mechanics of LP Staking

After gaining an understanding of liquidity pools, let’s move on to the key aspect of decentralized finance (DeFi): Liquidity Pool (LP) Staking. This process is a step beyond simply contributing to liquidity pools and involves engaging in a more active role within the DeFi ecosystem.

What is LP Staking?

LP Staking is the process of locking your LP tokens, which you receive after contributing assets to a liquidity pool, into a smart contract to earn additional rewards. This is different from just earning transaction fees as a liquidity provider. LP staking involves participating in additional reward mechanisms often offered by DeFi platforms.

How LP Staking Works?

You receive LP tokens in return when you add assets to a liquidity pool (a pair of tokens). These tokens represent your share in the pool. In LP staking, you stake these tokens into a specific smart contract designed to distribute rewards.By staking your LP tokens, you become eligible for additional rewards, often paid in the platform's native token or other cryptocurrencies.

Imagine you're a farmer who joins a community market. You bring apples and oranges to the market and put them in a common stall (this is like adding assets to a liquidity pool). In return for contributing, you get special market tokens that show your share in the stall. Now, imagine there's a scheme in the market where, if you lock your market tokens in a safe (akin to staking LP tokens), you get extra rewards like more fruits or market credits.

The Role of LP Staking in DeFi

LP staking plays a significant role in the DeFi ecosystem. It not only incentivizes users to provide liquidity but also helps maintain the stability and efficiency of the platform. It's a mechanism that rewards participation and commitment.

Advantages of LP Staking

- Additional Rewards: Apart from transaction fees, stakers earn extra rewards, increasing their potential income.

- Supporting the Ecosystem: By staking LP tokens, users contribute to the robustness and liquidity of the DeFi platform.

Risks Involved in LP Staking

- Impermanent Loss: Similar to liquidity providing, stakers are subject to impermanent loss, especially if the price of staked tokens changes significantly.

- Smart Contract Risks: Staking involves interacting with smart contracts, which might have vulnerabilities or bugs.

LP Staking is a compelling aspect of the DeFi world, offering users a way to increase their earnings by participating in liquidity pools. While it comes with its set of challenges, such as the risk of impermanent loss and reliance on smart contract security, its benefits in enhancing potential rewards and supporting the DeFi ecosystem make it an attractive option for many users. Understanding LP staking's mechanics is vital for anyone looking to deepen their engagement in the DeFi space.

Humanode's Nonlinear LP Staking: A Revolutionary Approach

Now that we have a grip on the mechanics of LP Staking and its significance in DeFi, it's time to explore an innovative approach that's transforming this space: Humanode's Nonlinear LP Staking. This is where traditional concepts meet revolutionary ideas, reshaping our understanding of reward systems in DeFi.

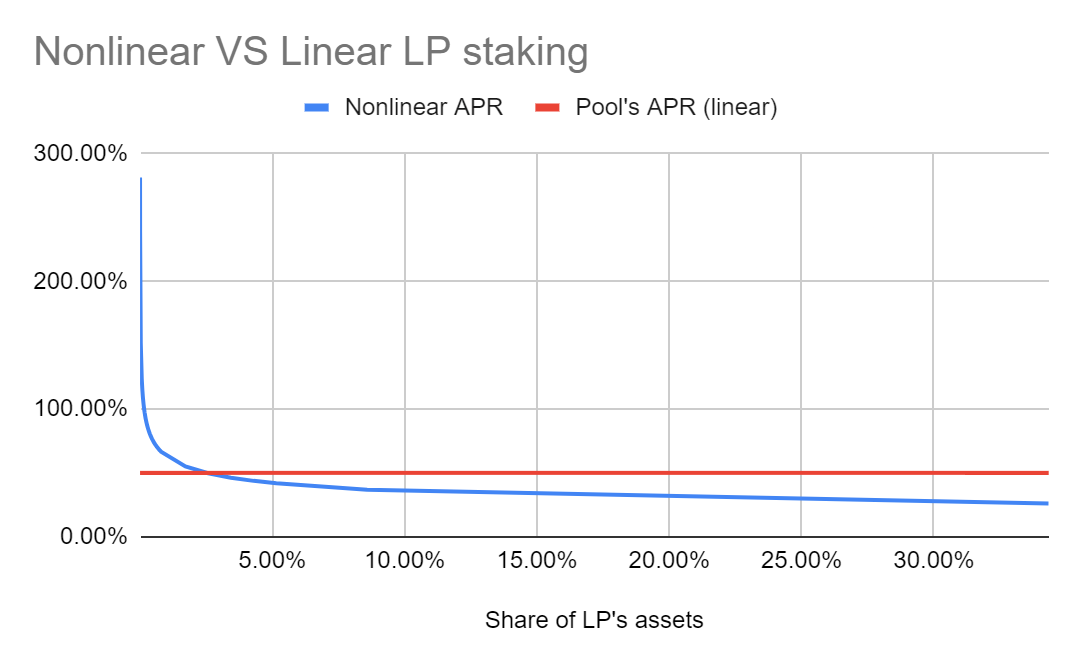

Humanode's system introduces a novel concept in the DeFi space: Nonlinear LP Staking. This approach deviates from the standard linear staking models where rewards are typically proportional to the amount staked.

Nonlinear LP Staking redefines reward distribution in a way that doesn't solely favor larger liquidity providers, commonly called 'whales'. This model is designed to provide a more equitable distribution of rewards, ensuring that smaller liquidity providers are not disproportionately disadvantaged.

Here's an illustration to understand the difference between Linear and Nonlinear LP staking:

How Does It Work?

In Humanode's model, the annual percentage rate (APR) of rewards isn’t proportional to the liquidity provider's contribution to the DEX pool. Instead, it uses the function f(x) = x^ ¾. The APR decreases as one's share in the pool increases, meaning smaller liquidity providers see relatively higher APRs than larger liquidity providers. To understand the reward distribution mechanism in depth, read this article on Non-Linear LP staking.

A crucial aspect of this model is its resistance to Sybil attacks. By using confidential facial scans for user verification, Humanode ensures that each participant is unique, preventing individuals from gaming the system with multiple accounts.

Imagine a community garden where people can contribute plants. In traditional gardens (linear staking), the more plants you contribute, the more fruits you get. In Humanode’s garden (nonlinear staking), the rewards aren’t just based on how many plants you add. If you add fewer plants, you get more fruits per plant. This way, even those with fewer plants get a fair share of the fruits.

Advantages of Humanode's Nonlinear Staking

- Fairness: Smaller liquidity providers have a chance to earn a significant return on their investment, leveling the playing field.

- Incentivizing Broader Participation: This approach encourages a wider range of liquidity providers to participate, enhancing the overall liquidity of the pool.

- Sybil resistance: The use of cryptobiometrics adds a layer of security and ensures the uniqueness of each participant. Biometrically secured staking sets a new standard for security in crypto transactions and staking.

Humanode’s Nonlinear LP Staking model is more than just an alternative approach to staking in the DeFi space; it represents a shift towards a more decentralized, fair, and secure ecosystem. As the DeFi landscape continues to evolve, models like Humanode’s will play a significant role in shaping the future of DeFi investments and staking. Adapting to and embracing these changes will be crucial for all participants in the DeFi sector, from small-time liquidity providers to large-scale players.

Key Takeaways

In conclusion, our exploration through the realms of staking and LP staking in DeFi has been enlightening. Let's sum up the key takeaways that not only demystify DeFi but also highlight the exciting opportunities and innovations shaping its future.

Staking: Whether it's active or passive, staking involves locking up crypto assets to support a blockchain network. It's like earning interest or rewards for helping the network run smoothly.

Liquidity Pools: These are like big pots of two types of tokens. They help people trade tokens easily on decentralized exchanges. Think of it as contributing to a communal resource that everyone can use.

LP Staking: This goes a step further. After you add to liquidity pools, you can 'stake' your proof of participation (LP tokens) to earn extra rewards. It's like a community project where even small contributions are valued and rewarded well.

Nonlinear LP Staking: Humanode's approach changes the game. It's about ensuring everyone has a fair chance to earn rewards, no matter how much they contribute. It's like a community project where even small contributions are valued and rewarded well.

Final Thoughts

The world of DeFi is evolving rapidly, and it's an exciting time to be involved. From ensuring network stability through staking to contributing to liquidity pools and engaging in innovative staking models like Humanode's, there are many ways to participate and benefit. These developments make DeFi not just a space for investment but also a platform for innovation and inclusivity. Whether you're just starting or are an experienced player in the crypto world, understanding and embracing these concepts is key to navigating the DeFi ecosystem successfully.